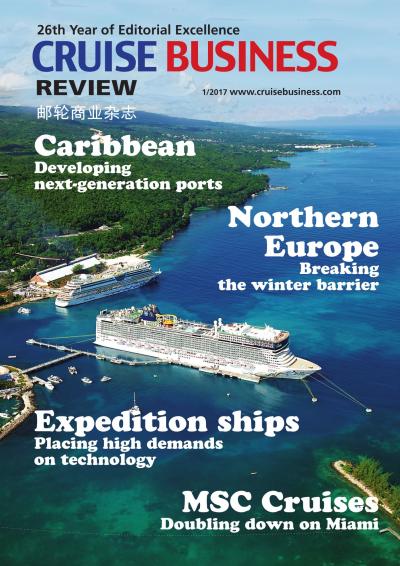

Cruise Business Review

1/2017

Huom! Valittuna on arkistonumero. Uusin ilmestynyt numero on Winter/2026

Arkistonumerot

![]() Winter/2026

Winter/2026![]() Summer/2025

Summer/2025![]() Spring/2025

Spring/2025![]() Winter/2025

Winter/2025![]() Summer/2024

Summer/2024![]() Spring/2024

Spring/2024![]() Winter/2024

Winter/2024![]() Summer/2023

Summer/2023![]() Spring/2023

Spring/2023![]() Winter/2023

Winter/2023![]() Summer/2022

Summer/2022![]() Spring/2022

Spring/2022![]() Winter/2022

Winter/2022![]() Summer/2021

Summer/2021![]() Spring/2021

Spring/2021![]() Winter/2021

Winter/2021![]() Summer/2020

Summer/2020![]() Spring/2020

Spring/2020![]() Winter/2020

Winter/2020![]() Summer/2019

Summer/2019![]() Spring/2019

Spring/2019![]() Winter 2018/2019

Winter 2018/2019![]() 2/2018

2/2018![]() 1/2018

1/2018![]() 3/2017

3/2017![]() 2/2017

2/2017![]() 1/2017

1/2017

Lehtiluukku.fi

Lehtiluukku.fi